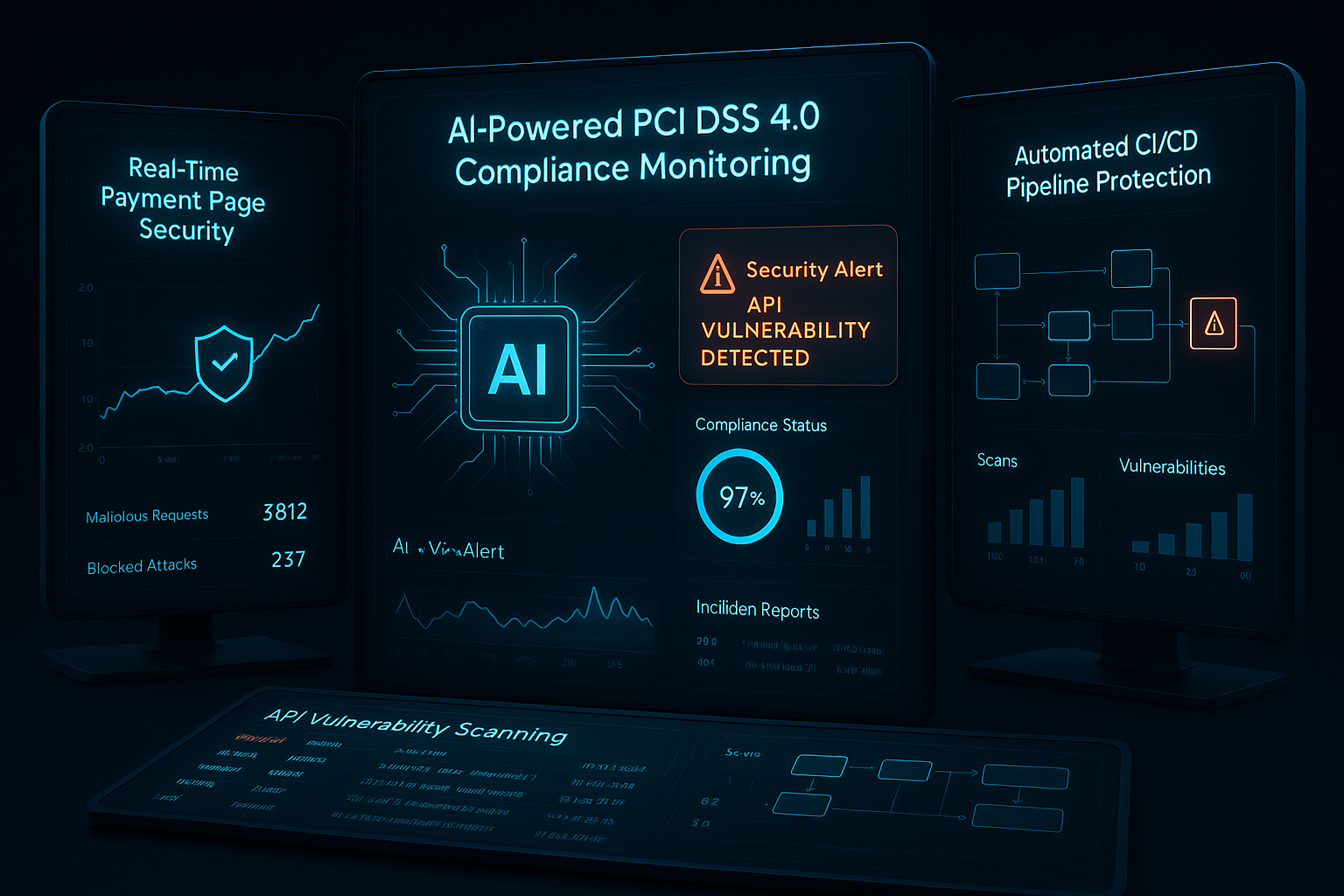

PCI DSS 4.0, Automated: Continuous Controls with AI Across Apps, APIs, and CI/CD

The countdown to March 31, 2025 is over—but the journey toward PCI DSS 4.0 automation is just beginning. As organizations scramble to meet the new Payment Card Industry Data Security Standard requirements, compliance teams are discovering that traditional manual approaches simply don't scale in today's dynamic digital environments. The solution? Intelligent automation powered by AI that transforms compliance from a periodic fire drill into a continuous, embedded security practice.

The New PCI DSS 4.0 Landscape: Why Automation Matters

PCI DSS 4.0 introduces fundamental shifts that demand automated approaches. Key industry leaders like Thales, DataDome, and Linford have emphasized three critical changes that make automation essential:

Payment Page Tamper Detection (Requirement 11.6.1) mandates real-time monitoring of payment pages for unauthorized modifications. Manual script reviews simply can't keep pace with the dynamic nature of modern web applications where third-party scripts, CDN updates, and A/B testing constantly change page behavior.

Targeted Risk Analysis (TRA) replaces one-size-fits-all compliance frequencies with risk-based decision making. Organizations must now justify control frequencies through structured risk assessments—a process that benefits enormously from AI-driven threat intelligence and automated risk scoring.

Expanded CI/CD Coverage brings development pipelines directly into PCI scope. With modern organizations deploying code hundreds of times per day, manual security reviews create dangerous bottlenecks that automation can eliminate.

The Automation Blueprint: Building Continuous PCI DSS 4.0 Controls

Successful PCI DSS 4.0 automation requires a multi-layered approach that addresses data discovery, continuous monitoring, and evidence collection across your entire technology stack.

AI-Assisted Data Discovery and CDE Scoping

Traditional cardholder data environment (CDE) scoping relies on network diagrams and periodic interviews—approaches that quickly become outdated in cloud-native environments. AI-powered data discovery tools can automatically:

- Scan applications, databases, and file systems for cardholder data patterns

- Map data flows across microservices and API integrations

- Update CDE scope boundaries automatically as infrastructure changes

- Generate visual network topologies showing data paths and trust boundaries

Tools like Salt Security's API Discovery leverage machine learning to identify APIs handling cardholder data and flag when sensitive information is transmitted over unencrypted channels—addressing multiple PCI DSS 4.0 requirements simultaneously.

Continuous Secrets Scanning in CI/CD Pipelines

With PCI DSS 4.0 explicitly covering CI/CD environments, organizations must implement automated secrets detection throughout their development lifecycle. Modern secrets scanning goes beyond simple regex patterns to include:

- Context-aware detection that understands when a string represents an actual secret versus test data

- Historical repository scanning to identify secrets committed in previous versions

- Real-time pipeline integration that blocks deployments containing exposed credentials

- Automated remediation workflows that revoke compromised keys and notify affected teams

Platforms like Aptori act as AI Security Engineers, integrating directly into Software Development Lifecycle (SDLC) processes to scan, triage, and fix vulnerabilities in real time—ensuring secrets never reach production environments.

Bot Defense and WAF Protection for Payment Pages

Requirement 11.6.1's payment page tamper detection works hand-in-hand with broader application security measures. AI-powered bot management and Web Application Firewall (WAF) solutions provide:

- Behavioral analysis that distinguishes legitimate users from malicious bots attempting to inject scripts

- Real-time script monitoring that detects unauthorized changes to payment page content

- Automated blocking of suspicious traffic patterns that could indicate card skimming attacks

- Forensic capabilities that preserve evidence of attempted tampering for compliance audits

DataDome's Page Protect exemplifies this approach, enabling automated PCI DSS 4.0 compliance by continuously monitoring payment pages and immediately alerting security teams to unauthorized modifications.

API Posture Management: The New Compliance Frontier

APIs represent one of the fastest-growing attack surfaces in modern applications, and PCI DSS 4.0 reflects this reality with enhanced API security requirements. Automated API posture management includes:

Comprehensive API Inventory Management

- Automated discovery of both documented and shadow APIs across your environment

- Data classification to identify which APIs handle, store, or transmit cardholder data

- Security posture assessment evaluating authentication, encryption, and access controls

- Continuous monitoring for new API endpoints and configuration changes

Real-Time Security Policy Enforcement

- Centralized policy management that enforces consistent security controls across all APIs

- Automated compliance checking against PCI DSS 4.0 requirements

- Risk-based alerting that prioritizes high-impact security findings

- Integration with development workflows to catch issues before production deployment

Passwordless Authentication and Risk-Based Access

PCI DSS 4.0 emphasizes strong authentication mechanisms, making this an ideal time to implement passwordless and risk-based authentication (RBA) systems. Automated approaches include:

- Behavioral biometrics that continuously verify user identity based on typing patterns, mouse movements, and other unique characteristics

- Device fingerprinting that identifies suspicious login attempts from unknown devices

- Contextual risk scoring that considers location, time, and access patterns when making authentication decisions

- Automated step-up authentication that requests additional verification only when risk levels increase

These systems not only enhance security but also improve user experience by reducing friction for legitimate users while maintaining strong protection against unauthorized access.

Operationalizing Targeted Risk Analysis

The introduction of Targeted Risk Analysis represents one of PCI DSS 4.0's most significant changes, requiring organizations to justify control frequencies through structured risk assessments. Automation transforms TRA from a manual burden into a strategic advantage:

Automated Threat Intelligence Integration

- Real-time threat feed ingestion from industry sources, government agencies, and commercial providers

- Contextual threat analysis that maps external threats to your specific environment and technologies

- Automated risk scoring that quantifies the likelihood and impact of different attack scenarios

- Dynamic control frequency adjustment based on changing threat landscapes

Evidence-Based Risk Justification

- Historical attack data analysis showing actual threat patterns in your environment

- Peer benchmarking comparing your risk posture to similar organizations

- Automated documentation generation creating the written justifications required for TRA compliance

- Continuous risk reassessment ensuring your analysis remains current as conditions change

Third-Party and Vendor Monitoring Automation

PCI DSS 4.0 strengthens third-party service provider requirements, mandating validation every six months for service providers. Automated vendor monitoring addresses these requirements through:

Continuous Compliance Monitoring

- Automated certificate verification ensuring vendor security certifications remain valid

- Real-time security posture assessment of third-party services and APIs

- Automated compliance gap identification highlighting areas where vendors fall short of requirements

- Risk-based vendor scoring prioritizing remediation efforts based on potential impact

Contract and SLA Management

- Automated contract analysis identifying security requirements and performance metrics

- SLA monitoring and alerting tracking vendor compliance with agreed-upon security standards

- Automated reporting providing stakeholders with regular updates on third-party risk

- Incident coordination facilitating rapid response when vendor security issues arise

Quick-Start Toolkit: Essential Automation Tools

Organizations beginning their PCI DSS 4.0 automation journey should prioritize these essential tools:

DAST/SAST with AI Policy Integration

- Dynamic Application Security Testing (DAST) tools that automatically scan running applications for vulnerabilities

- Static Application Security Testing (SAST) solutions integrated into CI/CD pipelines

- AI-powered policy engines that translate PCI DSS requirements into actionable security rules

- Automated remediation suggestions helping developers fix vulnerabilities faster

API Security and Inventory Management

- API discovery platforms that maintain real-time inventories of all API endpoints

- Security testing frameworks specifically designed for API vulnerabilities

- Traffic analysis tools monitoring API usage patterns for anomalies

- Compliance reporting engines generating PCI DSS-specific API security reports

Page Integrity and Script Monitoring

- Client-side protection platforms monitoring payment pages for unauthorized changes

- Script inventory management tracking all JavaScript and other executable content

- Real-time alerting systems notifying security teams of potential tampering

- Forensic analysis tools providing detailed evidence for compliance audits

Before and After: The Audit Evidence Transformation

The difference between manual and automated PCI DSS 4.0 compliance becomes most apparent during audit cycles:

Traditional Manual Approach

- Quarterly evidence gathering sprints creating organizational disruption

- Static documentation that may not reflect current configurations

- Sample-based testing providing limited visibility into actual security posture

- Reactive issue identification discovering problems only during audit cycles

Automated Continuous Compliance

- Real-time evidence collection maintaining audit-ready documentation continuously

- Dynamic compliance dashboards showing current status across all requirements

- Comprehensive testing coverage examining 100% of transactions and configurations

- Proactive issue resolution identifying and addressing problems before they impact compliance

Implementation Roadmap: From Fire Drill to Strategic Advantage

Successful PCI DSS 4.0 automation follows a phased approach:

Phase 1: Foundation (Months 1-2)

- Implement automated data discovery and CDE scoping

- Deploy CI/CD pipeline security scanning

- Establish basic API inventory management

Phase 2: Enhancement (Months 3-4)

- Add payment page tamper detection capabilities

- Implement automated secrets management

- Deploy risk-based authentication systems

Phase 3: Optimization (Months 5-6)

- Operationalize targeted risk analysis workflows

- Implement comprehensive third-party monitoring

- Establish continuous compliance reporting

Phase 4: Continuous Improvement (Ongoing)

- Refine AI models based on operational experience

- Expand automation coverage to additional security domains

- Integrate with broader security orchestration platforms

The Strategic Value of Automated Compliance

While meeting the March 31, 2025 deadline was the immediate driver, PCI DSS 4.0 automation delivers lasting strategic benefits:

- Reduced compliance costs through elimination of manual processes

- Improved security posture via continuous monitoring and rapid response

- Enhanced audit readiness with real-time evidence collection

- Operational efficiency freeing security teams to focus on strategic initiatives

- Competitive advantage through faster, more secure payment processing

Conclusion: Building Tomorrow's Compliance Infrastructure Today

PCI DSS 4.0 represents more than regulatory compliance—it's an opportunity to transform how organizations approach security in an increasingly automated world. By implementing AI-driven continuous controls across applications, APIs, and CI/CD pipelines, forward-thinking organizations aren't just meeting today's requirements; they're building the foundation for tomorrow's digital business success.

The tools and techniques outlined in this automation blueprint provide a practical starting point, but success ultimately depends on organizational commitment to continuous improvement and strategic security thinking. As payment technologies continue evolving, automated compliance frameworks will become increasingly essential for maintaining competitive advantage while protecting customer trust.

Ready to transform your PCI DSS compliance from a manual burden into a strategic advantage? JMK Ventures specializes in AI automation and digital transformation strategies that help organizations build robust, scalable compliance frameworks. Our team can help you implement the automated controls and continuous monitoring capabilities needed to not just meet PCI DSS 4.0 requirements, but to establish a foundation for long-term security excellence. Contact us today to learn how we can accelerate your journey toward intelligent compliance automation.

%20(900%20x%20350%20px)%20(2)%20(1)%201%20(1).svg)

%20(900%20x%20350%20px)%20(4).png)